Introduction

There are many good ways to pool your assets with other investors, and make more effective use of gas fees. Because of the way Eth network fees are structured, it is more efficient to be able to make small numbers of large transactions than numerous small ones. And experimentation is costly.This can easily eat up a big chunk of your profit if you don't find a way to reduce gas costs, and this is one of the best ones. Pooling resources has become important as network fees continue to rise, while we wait for scaling solutions to be safely implemented.

Also earning strategies are becoming more complex as the ecosystem grows. It is hard to keep track of all the opportunities on your own, and execute the best ones at the right time. Most of these yield aggregation solutions are also incorporating insurance coverage (Opyn and Nexus) to manage risk of smart contract bugs or hacks. Returns are a matter of trading off risk for reward, and there are a lot of things to consider when choosing a strategy. You also have to take into account your time horizon (short vs. long term), and higher risk associated with shorter timelines. Many of these solutions are providing strategies on behalf of the investors/stakers, that take many of these things into account. You can chose the best ones for your own situation.

Yield Aggregators

Live and tested

Idle.Finance

This project supports different lending platforms and automatically moves (rebalances) combined funds from one platform to another to get the best rates. The smart contracts are audited and the app is easy to use. You can chose to get "best rates" or risk adjusted strategies (second one is insured). It worked well for me when I tested it. After you deposit stablecoins, you receive idletokens which are used for redemption which you can withdraw at any time.This project is non-custodial and decentralised. It is a fairly low risk alternative, and you can currently earn about 6% APR on stablecoins like Dai. They are supposed to be partnering with Synthetix for some additional rewards, in the near future.

RAY Robo advisor (Staked.us)

The service is a centralised alternative to idle.finance, and you have to provide kyc/aml. The company behind it is primarily a staking service, and it also has the robo lending aggregator service. The smart contracts are Opensource, and rebalance funds automatically based on supported lending services like Compound, Dydx etc.

Rari Capital app

According to them "Currently, Rari generates yield by depositing a combination of DAI and USDC to the lending protocol dYdX as well as DAI, USDC, and USDT to the lending protocol Compound. In the near future, we will be generating yield from more currencies across more lending protocols, among other strategies." They also take a 20% performance fee. Still pretty new, this one takes the approach of letting you invest in a fund, which they manage for you, so there is a certain amount of trust involved, and it is less open and transparent than some of the fully decentralised solutions. The current APR is 9%. The main advantage is "ease of use". Funds start earning interest as soon as they are deposited.

- The fund

- More detail

- Under the hood

In progress

Plutus

This is another yield aggregator for stablecoins, with the added feature of privacy. They will also be supporting derivatives and payroll and payments in the future. They have a pretty ambitious vision: "PlutusDefi is a protocol that unifies leading DeFi protocols and blockchain infrastructure by standardising communication between them to create and execute complex financial transactions, while championing Privacy, Anonymity and Sovereignty" We will see if they can pull it off, and get adoption. Their initial liquidity mining initiative experienced some glitches.

Akropolis Protocol

They are similar to Plutus, but without the emphasis on privacy. The smart contracts are audited by Certik. They have made the platform flexible for developers to build their own Defi products. They used the Robo advisor from staked.us (see above) for their lending aggregator platform (called Delphi). Their first product is called Sparta:

"So what can you do as a Sparta v0.1 user? Things that our members can do:

- Contribute funds to the pool and hold internal pTokens (pool shares). Their price is determined by the bonding curve and changes as a function of liquidity amount in the pool. It is designed to allow for secondary liquidity management and our version of “ragequit”;

- Take out an undercollateralised loans from the pool (providing only 50% of collateral, i.e. 50% LTV or Loan-to-Value);

- Lend funds to members of the pool by staking in favour of their loan request and earn higher APR (please remember higher APR reflects higher risk)."

The main feature is the undercollateralized loans, which none of the other Defi lending platforms have yet. It is open and extensible, and will be interesting to see what other people build and integrate with this platform. They have an ambitious roadmap, which includes liquidity mining rewards

Xio

This is a new approach to pooled staking rewards, which they call "flash staking". So, they deal with the staking lock-ins, and also make it easier for the average investor without technical expertise to benefit from aggregated earnings that are derived from staking various "early stage" projects, which is becoming very popular due to "Proof of Stake" consensus.

"Through the XIO Dapp, users can earn instant upfront interest on various ERC tokens for staking. In short, it’s like Uniswap, but for staking instead of trading."

It is still in the early stages, and we will have to see how it pans out. But they are getting some good hype and promotion.

Yield aggregators with Incentives (Yield farming rewards)

Yearn.finance

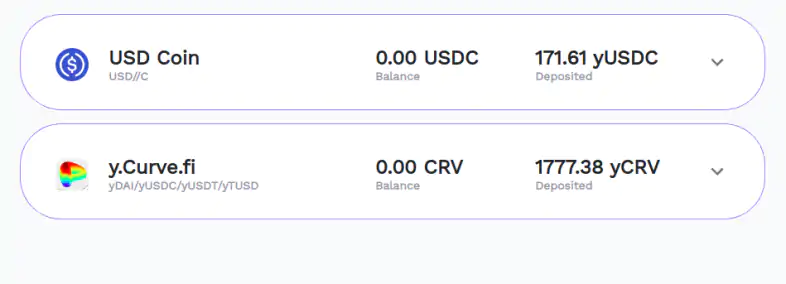

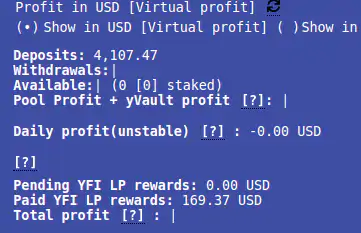

This solution comprises a whole ecosystem of services. From ycosystem.info, scroll down to the yearn.finance product and go into the yvaults, where you can deposit USDC, or stake your ycrv tokens (from y.curve.fi- see below), and soon Link and SNX tokens. They will re-invest and grow your funds, by using different strategies, which are the best combination of risk/reward. There are some existing strategies provided by Andre Cronje (experienced, well known yield farmer), or contributed by the community for a share of the rewards. The governance token (called YFI), is decentralised, and the contracts are opensource. Version 1 is audited by Quantstamp, but V2 hasn't been audited yet, so you might want to wait for this.

This solution is a good way to earn good rewards, without having to do a lot of research and monitoring for the best opportunities as they arise. You can check your profits on y.curve.fi for each vault:

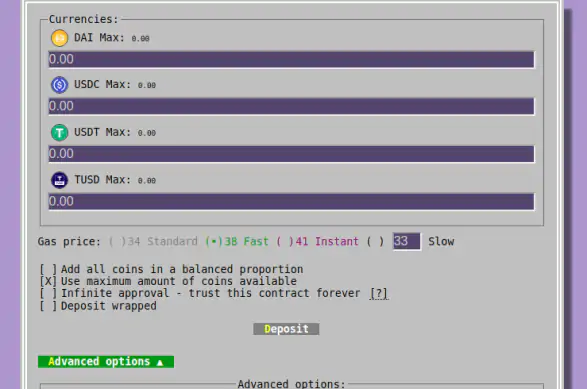

Curve.fi

This is a bonding curve DEX/AMM for stablecoins and xBTC tokens. If you provide liquidity to any of the supported coin/pools, you get a share of the transaction fees. If you contribute to one of the pools that they are partnered with such as Synthetix and Yearn, you will also get additional rewards. For example, you can provide liquidity to y.curve.fi, and receive a ycrv token which you can stake on the yearn yield aggregator (discussed above):

Also, curve will be releasing their governance token called CRV, very soon (probably by next week) which will earn additional rewards for users of the platform, as well as enable you to participate in the governance decisions.

Mstable (Musd)

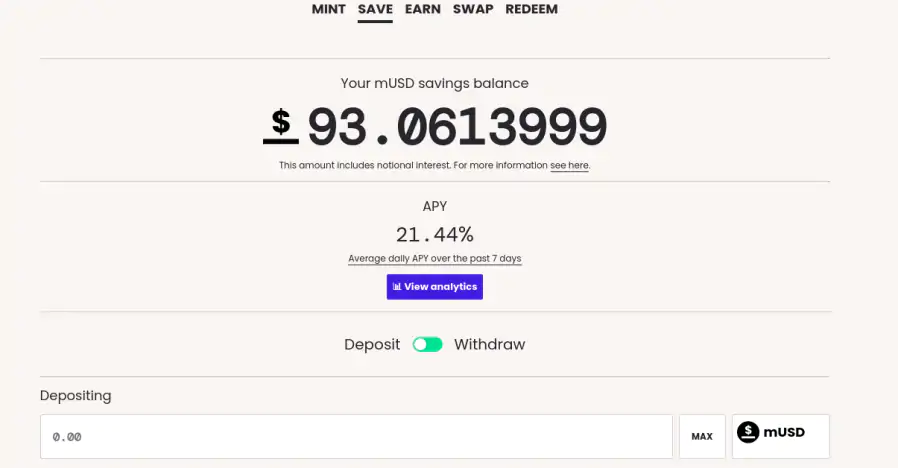

You can deposit the musd stablecoin under "save" in the app, and get around 20% apr (currently):

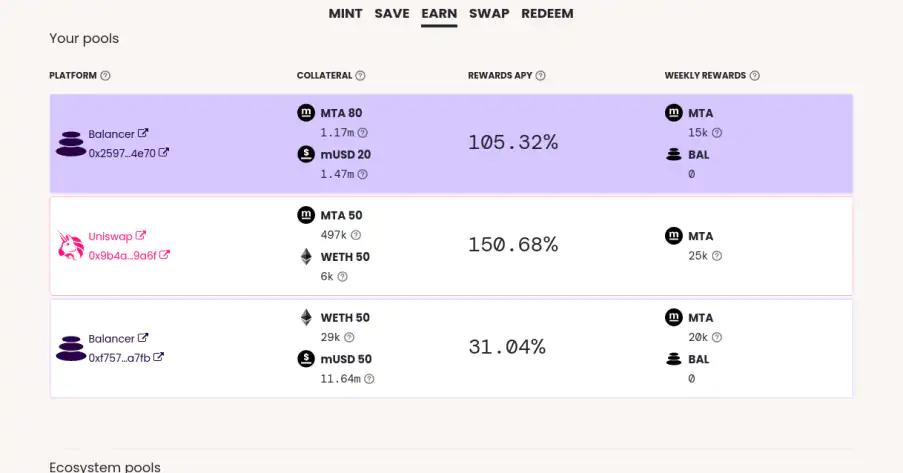

You can also contribute liquidity to one of the various pools, and earn MTA governance tokens as a reward:

Synthetix - see previous article about how to earn with SNX and rewards

I recently came across a very cool site which allows you to use the Chi token to save on gas fees when claiming SNX rewards from staking. There will also be pooled staking vaults from yearn, as soon as they are approved by the community governance shortly.

Balancer - see previous article where I talk about how to earn with BAL and rewards

There are tons of projects now using Balancer to mine liquidity, earn bootstrapping rewards for their token, earn transaction fees for swapping, and also BAL tokens (which have now been listed on Coinbase).

There are also several projects using Uniswap liquidity pools, which still have higher liquidity, but no governance token for Uniswap, as of yet. This is highly anticipated, if it happens since they havn't announced anything yet.

Conclusion

The first group of alternatives are safer, but also have lower returns. The second group with additional yield farming incentives have higher yields because they take advantage of defi composability. They re-invest the same funds on more than one platform. So, you get higher rewards, but also more risk since you are relying on more smart contract platforms. When there are more moving parts there are more possibilities for things to go wrong. Also, many of the liquidity mining rewards are only temporary, so they expire, usually in a few weeks, or in some cases, months. So, they have to be monitored, and that's why an option like Yearn vaults is so good. They do all the hard work for the pool, and the gas fees are shared, as well as the rewards (in exchange for liquidity).

So, you can chose a strategy which is good for you and your situation, keeping in mind that the rewards are proportional to the risks. A good approach is to diversify your portfolio by splitting your investments into different services, and not putting all your eggs into 1 basket. Be careful to chose projects which incorporate insurance, and audits. Also be mindful about which of your investments involve stablecoins (Ex. MUSD, USDC, Dai etc.) which won't move with the overall market, or volatile coins (ex. BTC, Eth, LINK, SNX, BAL, MTA) which will tend to go up when the market index increases. In a bull market, you probably want to increase your exposure to the volatile coins, and decrease stablecoins % of total. The opposite is true for a bear market. I try to focus on the medium to long term since its so hard to predict what can happen in the short term.

As usual, feedback is welcome. I would like to hear what you think. I will update the post as new services and opportunities become available.

The text on this page is based on the original post and does not claim the copyright of the owner in any way. Everything written here is a free interpretation of the original post. Media

Media