Content of article:

- PFP Mania of Q2

- Retail Giants and the Metaverse

- OpenSea Summer

- The Rise of GameFi

Last week, OPENSEA saw a total volume of ?114k. At the same time last year, the platform saw a total of ?1.18k exchange hands. There are a lot of dominoes that need to fall in order for a market to increase 9567% in just one year. One of the earliest dominoes was Beeple selling his “Everydays – The First 5000 Days NFT” for $69 million at Christie’s auction house in February.

This was the sixth-highest sale by a living artist at the time, digital or physical. This sale really brought the market into the mainstream spotlight. From there, the market exploded.

PFP Mania of Q2

After the Beeple sale, NFT profile picture (pfp) sales began to pick up. This is when some of the most valuable projects available today minted.

Projects like:

- BAYC

- CyberKongz

- Gutter Cat Gang

Released in Q1/Q2 of 2021, they have more than sustained their floor values. Even CryptoPunks, originally minted in 2017, has also seen almost unfathomable growth this year.

The collection was sitting at an average sale price of ?5 in January, which at the time was just over USD $5000. Now, the floor price sits at ?65.95 at the time of writing, or over $255k. A cool 250k profit at sales floor in one year, Punks look like a pretty good investment in hindsight.

Retail Giants and the Metaverse

With the insane growth NFTs have seen this year comes the actual applications and adoption of this tech by the mainstream. Massive companies see the value-creating opportunities and want their piece of the pie.

With the wealth of monetization opportunities the early stages of the metaverse provide, companies like:

have either partnered with prominent collections or have issued their own NFT. Metaverse wearables will be all the craze in 2022, and we’re starting to see the beginning of it. Adidas partnering with BAYC and Nike acquiring RTFKT is only the beginning.

OpenSea Summer

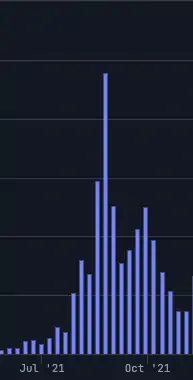

This past summer was the quarter of NFTs, with unbelievable volume flowing through the largest platforms. At the peak of August, OpenSea saw ?477k in volume in just a single week.

Projects you most likely recognize like:

- Cool Cats

- Lazy Lions

- MAYC

deployed during this bull run, and the NFT market that we are accustomed to began. A shift towards utility began, and projects were no longer valued simply on the art or community they provide access to. Instead, projects began to have value based on what they provide to the holder.

For example, BAYC airdropped serums to their holders, which gave them a Mutant Ape. This brings actual tangible value to BAYC holders. Various projects introduced tokens and staking, allowing holders to further derive value from their investments.

The Rise of GameFi

Finally, a new category of video games has begun to establish itself with the rise of NFTs. With digital ownership comes monetization. We are used to the massive companies being the benefactors of the monetization to this point.

But Web3 is looking to change that. Instead of the game developer owning every asset within a game, Web3 puts that in the hands of the players themselves.

Also, games like Axie Infinity saw meteoric growth, setting the tone for the future of video games. Players can buy, sell, trade, and upgrade their assets, creating a self-sustaining-player-run ecosystem.

Thetan Arena hit 6 million daily active users only 15 days after release. That number has since doubled by the way. If what we have seen in the space this year is any indicator of the future of the gaming industry, the future of the industry operates on the blockchain.

Also, something to consider: Remember always to do your research, make your own decisions, and invest in projects that interest you!

Follow our new Altcoin Buzz Public NFT Wallet to keep an eye on collections we’re buying, selling, and holding! Use this as a jumping-off point for your research.

0x7304689aAc83c3B236332B0C233878F1819cA89d

Media

Media