The crypto markets weren't the only thing that had dropped over the past week - the market sentiment crashed, leaving the positive zone. The average 7-day moving crypto market sentiment score (sentscore) for ten major coins fell from last week's 6.36 to 5.84 recorded today, when the market rebounded sharply, according to the crypto market sentiment analysis site Omenics.

Quite a few things are very much different from the last week's picture. The first thing noticed right away is that only two coins are in the positive zone now - down from the record nine. And even these two - bitcoin (BTC) and ethereum (ETH) - fell below the score of 7.

The rest of the coins are in the neutral zone, with the lowest being cardano (ADA)'s sentscore of 5.2.

Furthermore, all but one coin are red this time around. The drops are led by cardano's 19.5%, bitcoin's 15%, and polkadot (DOT)'s 14%. These are then followed by uniwsap (UNI), binance coin (BMB), and XRP, with drops around 11%, while the lowest decreases in scores are seen by litecoin (LTC), chainlink (LINK), and ethereum, between 7% and 5%.

The only coin that's green is the one that had been on the losing end with the lowest score for quite a while before last week - now recording its second win in a row over its peers. Tether (USDT) went up another 11%, making another stride towards the positive zone, now sitting at its very verge.

Sentiment change among the top 10 coins*:

Interpreting the sentscore’s scale:

- 0 to 2.5: very negative

- 2 to 3.9: somewhat negative zone

- 4 to 5.9: neutral zone

- 6 to 7.49: somewhat positive zone

- 7.5 to 10: very positive zone.

The 24-hour sentscore for the top 10 coins is even lower than it was last Monday: 5.48 compared to 5.85. Meanwhile, in the past 24 hours, half of the list is green, the other half red, both with relatively small percentages. On the green side, XRP leads the list with a 6.5% rise, while ETH and BNB have the smallest increases, more than 1% each. On the red side, LINK's is the largest drop, falling 4%, while the smallest is UNI's 1%.

But perhaps the most interesting change is that - wait for it - BTC is not the top coin by sentscore. After standing on equal footing last Monday, BTC has been 'flippened' so to say - its score is now not only below 7, but it's 6.3, the lowest it's been in months. ETH now rules the list with 6.8.

The remaining coins have scores ranging 5-5.8, except ADA, which is now the only coin below the score of 5 (4.8) - much like USDT had been for several weeks.

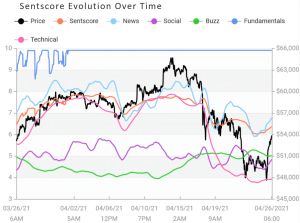

Daily Bitcoin sentscore change in the past month:

The 25 coins outside the top 10, which are also rated by Omenics, are very much red in the past seven days. Only two of them, USD coin (USDC) and monero (XRM), have seen an increase in their scores, of 6.5% and 3.6%, respectively. On the other hand, the drops are significant. The highest among these are EOS's and OMG network (OMG)'s more than 20%. The lowest drop is maker (MKR)'s 3%. It's also one of the three coins in the positive zone, down from fourteen last week, the other two being monero and algorand (ALGO). Among the rest, while most coins are in the 5-5.9 range, REN, NEM, and OMG are below 5 (4.5-4.7).

____

* - Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, "Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment," later adding, "Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin." For now, they are rating 35 cryptocurrencies.

Media

Media